Copying any information on this website, as well as using JustMarkets Brand Characteristics, is allowed only with the express written permission of JustMarkets. This website is owned and operated by Just Global Markets Ltd., which provides investment services.

Forex market time converter registration#

Just Global Markets (PTY) Ltd, registration number 2020/263432/07, address: 121 Beyers Naude, Roosevelt Park, Johannesburg, Gauteng, 2195, South Africa, authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51114. JGM International Pty Limited, registration number 700565, address: Law Partners House, Kumulu Highway, Port Vila, Vanuatu, authorized and regulated by the Vanuatu Financial Services Commission (VFSC).

Forex market time converter License number#

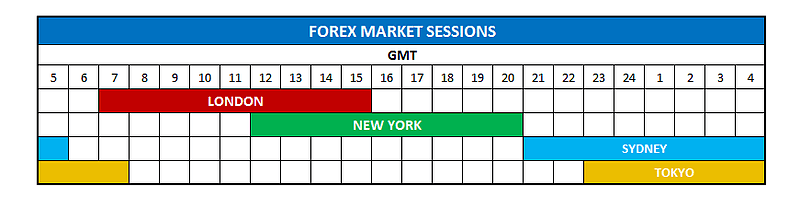

JustMarkets Ltd, registration number HE 361312, address: 13/15 Grigori Afxentiou street, IDE IOANNOU COURT, Office 102, Mesa Geitonia, 4003, Limassol, Cyprus, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 401/21 Just Global Markets Ltd., registration number 8427198-1, address: Office 10, Floor 2, Vairam Building, Providence Industrial Estate, Providence, Mahe, Seychelles, a company regulated by the Seychelles Financial Services Authority (FSA) under a Securities Dealer License number SD088 JustMarkets is a trading name of the group of companies consisting of: Learn trading today to take care of your future tomorrow. Trading strategy before you invest any money. A teaching account will help you learn the basics of FX trading and develop your own It’s a risk-free way to learn to trade in the Open a demo account on JustMarkets to try your hand at currency trading. Millions of people have already opened tradingĪccounts on JustMarkets to benefit from the best conditions, including low spreads, commission-free withdrawals, andĪ helpful team of support, working round the clock to ensure that each of our clients has the most convenient JustMarkets is an international broker with clients from 197 countries. Those trading pairs that don’t include the American dollar. However, other trading sessions can be interesting for The most active time of the forex market is considered the overlap of the European andĪmerican sessions starting at 3 pm East African time. This approach is good because it guarantees them high liquidity and volatility, so crucial for Most traders choose to trade during the mostĪctive trading hours. Organizing an optimal trading schedule may increase your trading results. You can see the detailed schedule for the major Thus, roughly speaking, the most profitable time for trading (especially when itĬomes to EUR/USD and GBP/USD) is from 3 to 6 pm (GMT+3). The North American trading session opens at 3 pm, and theĮuropean session closes at 6 pm. Start in the afternoon in the East African time zone. Thus the favorable trading hours (the overlap of the European and American sessions) High volatility provides you with better opportunities for profit, but it does not guarantee the profit itself.Įast Africa (Kenya, Tanzania, Djibouti, Madagascar, Somalia, etc.) is in the GMT+3 time zone, which means that it So, mind your trading instrument when you choose time to trade. GBP/JPY is another major currency pair that might also trade better during the AsianĪnd European sessions. For example, the NZD/JPY currency pair might make you trade during the early hours of the morning when In case you trade a currency pair without the dollar in it, shift your trading schedule to the hours of anotherįinancial center. All these factors guarantee increased volatility in the market. Second, the most important economic data is released at the same Large institutions exchange money during those hours. Firstly, there is high volatility because

Trading takes place during the overlap of the European and American sessions. The fact that the market is open 24 hours a day doesn’t mean you should trade any time you want. Up, the major European financial centers like Zurich, Frankfurt, and London start to trade. Trading begins early in the morning in New Zealand and Australia, then Asian markets join in.

Because of the variety of time zones, trading activity is different in different parts of the world at a particular time

0 kommentar(er)

0 kommentar(er)